What exactly is financial freedom? It is being free financially, not having to worry about whether you can pay the bills, or what happens if I am fired.

Financial freedom is achieved when your passive income is equal or more than enough to cover your expenses. And what exactly is passive income? Income can be classified into active and passive. First let us discuss active income, which is the income earned by doing work. Getting paid for working at Tim Horton’s, or the supermarket are examples of active income. If you do not go to work, you do not get paid. You have to actively work to receive your income, hence the name active income.

Passive income, on the other hand, is income that is earned with minimal effort or no work at all. You could be travelling the world, bumming at the beach, sleeping in when you are sick and you would still get paid! How is this possible?!

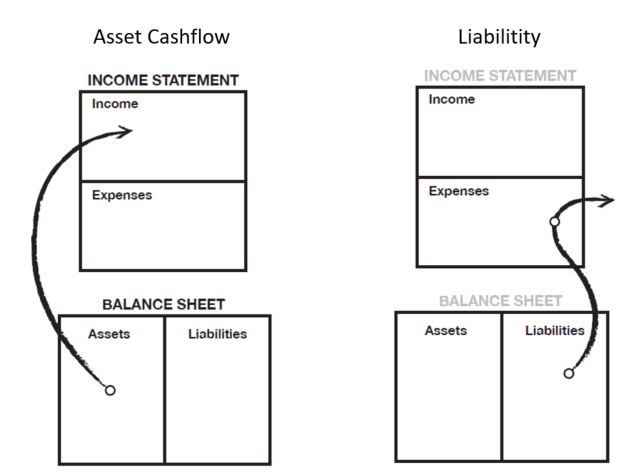

It all comes down to how much assets you have versus liabilities. Robert Kiyosaki’s concept of assets and liabilities differs from conventional definitions. Anything that puts money into your pocket is an asset and anything that takes money from you is a liability. See the diagram and video below. A car that you purchased would be considered an asset in conventional finance. However, if we look at it based on Robert Kiyosaki’s definition, the car would only be an asset if it was rented out and you received income from it. If the car was purchased for regular commuting and we had to pay for gas and maintenance, money is “flowing” out from our pockets and should be considered a liability (Kiyosaki, Rich Dad Poor Dad, 2011, p. 46).

With this understanding of assets and liabilities, the goal of financial freedom is to purchase assets that will generate enough passive income so that it is more or equal to one’s expenses.

You are truly financially free when you do not ever have to work again if you choose not to and still receive enough income from your assets such as a rental property or dividends from stocks, to cover your expenses.

Do you or your parents have more assets or liabilities? what are some ways that you think you could turn your liabilities into assets? Rent your unsold textbooks, half of your room, car out? I would love to hear from you. Please leave your comments below.

ps. If you found this valuable, please share it with others! 🙂

References:

Kiyosaki, R. T. (2011). Rich Dad Poor Dad. Scottsdale, Arizona, USA: Plata Publishing, LLC.