Arr! Treasure! What good is knowing about a treasure without the map! We have discussed the why of possibly pursuing the path of financial freedom in the 1st post, what is financial freedom in the 2nd post. Now let’s talk about actionable steps that we can take to realize this dream.

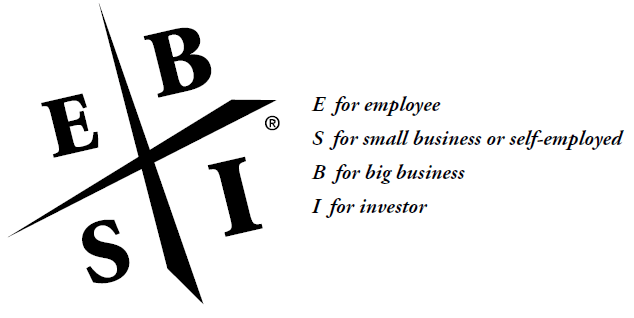

The types of people can be classified into 4 quadrants as illustrated in the figure below.

On the left side of the quadrant, there are the ‘E’ and ‘S’ people which stands for Employees and Self-employed. Employees work for others, while self-employed are people who work for themselves – they are a one-man business. On the right side of the quadrant, there are the ‘B’ and ‘I’ people which stands for Business Owners and Investors. Business owners employ people to work for them, while investors have large financial capital to invest and have their money “work for them” to generate more income. [image] The path to financial freedom is to work towards becoming people in the right quadrant – business owners and/or investors (Kiyosaki, Rich Dad’s Cashflow Quadrant, 2011, p. 13).

Realistically, many of us who graduate from college into the workforce will be on the left side of the quadrant as employees, simply because we will not have enough capital to be an investor or a business owner and that is fine.

The important thing here is to have a game plan to reach the right quadrant. Recall that the goal of achieving financial freedom is purchasing more assets that put money into your pocket so that your passive income will exceed your expenses.

In my opinion, we have two possible pathways to reaching the right quadrant, when we enter into the workforce as employees

Employee Pathway

Be the best you can be, specialize and do whatever it takes in your field to attract a high income, because of the value you bring to the employer. In this way, you can purchase more income-generating assets at a faster rate to reach financial freedom as an investor on the right quadrant.

Entrepreneurial Pathway

Many entrepreneurs or freelancers start as employees as well. The key difference here is that as you work, you are focused on learning the skills needed to start your own business. Examples of such skills may be sales, networking, negotiating, etc.

Once you have sufficient experience and decide to take the leap of faith to start your own business, you would most probably start as a self-employed because of your limited capital. The key here is to create systems so that when your revenue grows and you can afford to hire people, there is a system in place and it can run without you. By doing that, you are transiting to become the ‘B’ person – business owner in the right quadrant. An example of such system creation is to draft up the various “hats” that you wore as a start-up (sales, marketing, financial accounting, inventory management, etc.), into clear and detailed job descriptions and procedures.

Assets to purchase come in many forms. They can be businesses, stocks, bonds, rental properties that you collect rent on, royalties from intellectual properties such as art, music, book or patents. In essence, anything that generates passive income for the owner is an asset.

I hope that these posts have inspired you to consider an alternate pathway to life. Which pathway do you think you would take and why? I would love to hear your opinions! Please leave your comments below.

ps. If you found this valuable, please share it with others! 🙂

References:

Kiyosaki, R. T. (2011). Rich Dad’s Cashflow Quadrant. Scottsdale, Arizona, USA: Plata Publishing, LLC.